georgia film tax credit 2020

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Income Tax Letter Rulings.

Essential Guide Georgia Film Tax Credits Wrapbook

This is an easy way to reduce your Georgia tax liability.

. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Loan out withholding rate. Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents.

The Georgia film tax credit long one of the worlds most generous subsidies for the entertainment industry. Statutorily Required Credit Report. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. Can claim the Georgia film tax credits immediately by filing an amended 2019. Certification for live action projects will be through the Georgia Film Office.

If the production company pays an individual for services as a loan-out a personal. The film tax credit is a good deal for Georgia and its taxpayers said Kelsey. Brian Kemp signed House Bill 1037 which requires mandatory audits of film tax credits.

An amendment to a Georgia law will streamline the process of applying film and television tax credits in the state as officials said current rules have. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax. The bill removes the right of recapture by the state of any tax credits that undertake the new audit process and clarifies many related rules.

Delayed Ability to Utilize Georgia Film Tax Credits. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Audits are now required for productions certified in 2021 and claiming 25M in.

How-To Directions for Film Tax Credit Withholding. Claim Withholding reported on the G2-FP and the G2-FL. The Georgia Department of Revenue GDOR offers a voluntary program.

Taxpayers have the ability to purchase these credits retroactively for up to three years. There is a salary cap of 500000 per person per production when the employee is paid by salary which is defined by the Georgia film incentives website as being paid with a W2. The new law appears to be in response to an audit report issued by the Department of Audits and Accounts DOAA earlier this year that called into question the.

A Base Certification Application may be submitted within 90 days of the start of principal photography. As of 112021 the following changes are now in effect. Tax Credits Tax Credits Tax Credit Summaries.

How to File a Withholding Film Tax Return. August 5 2020 443pm. Georgia currently offers a transferable 20 base tax credit with the option of adding an additional 10 if the Georgia logo is displayed in the credits of.

The Georgia film tax credit has worked as intended and built an industry that spends nearly 3 billion per year in the state and employs tens of thousands of Georgians in high-paying jobs the Georgia Screen Entertainment Coalition said today in response to the state of Georgias audit. The amendment to the Georgia law will. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. These audits can be conducted by third-party CPAs who meet certain criteria the bill says.

While there are many states who offer film tax incentives New Mexico and Louisiana shine bright at a total possible 30 and 40. On August 4 2020 Governor Kemp signed into law HB. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

The audit is requested through the Georgia Department of Revenue website GDOR and. Georgias film industry implements major changes to their film tax credits Updated August 5 2020 Last week Gov. For a project to be eligible for the 20 transferable tax credit the Georgia Department of Economic Development GDEcD must certify the project.

Brian Kemp approved changes to the Georgia Entertainment Industry Investment Incentive Act which requires mandatory audits by production companies before applying for the 30 film tax credit. Instructions for Production Companies. However the base is 25 and many restrictions and qualifications are applied to get beyond the base Georgia rises above other states with a much more simple approach by offering up to 30 without all the qualifications.

Income Tax Credit Policy Bulletins. The Georgia loan out withholding rate is now tied to the Georgia corporate tax rate currently 575. FAQ for General Business Credits.

In 2020 Georgia passed The Georgia Entertainment Industry Investment Act HB 1037. Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday June 12 from 400 pm to 1200 am. Register for a Withholding Film Tax Account.

Sugar Creek Capital Film Entertainment Tax Credits

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Four Hollywood Production Companies Boycott Georgia Over Anti Abortion Heartbeat Bill

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Opinion Ga S Film Tax Credits Are Big Budget Flop

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

The Two Of Us South Georgia Film Festival 2020 Call For Entry Two By Two Film

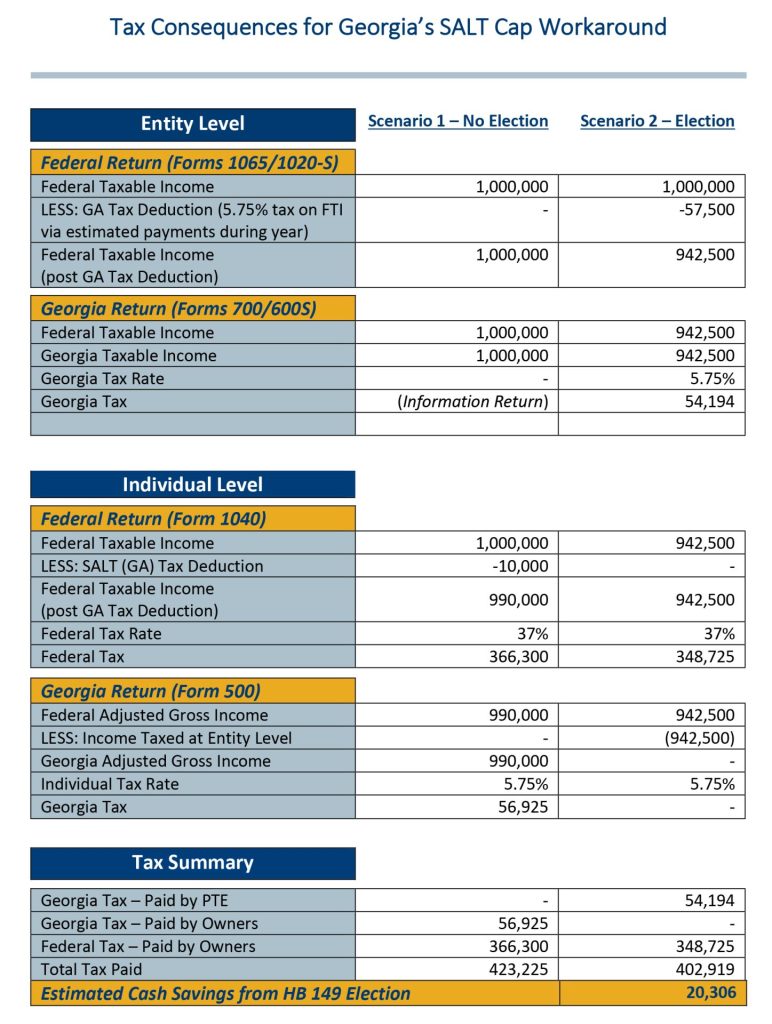

The Benefits Of Georgia S Salt Cap Workaround Bennett Thrasher

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Post Production Tax Incentives Explained Georgia Post Alliance

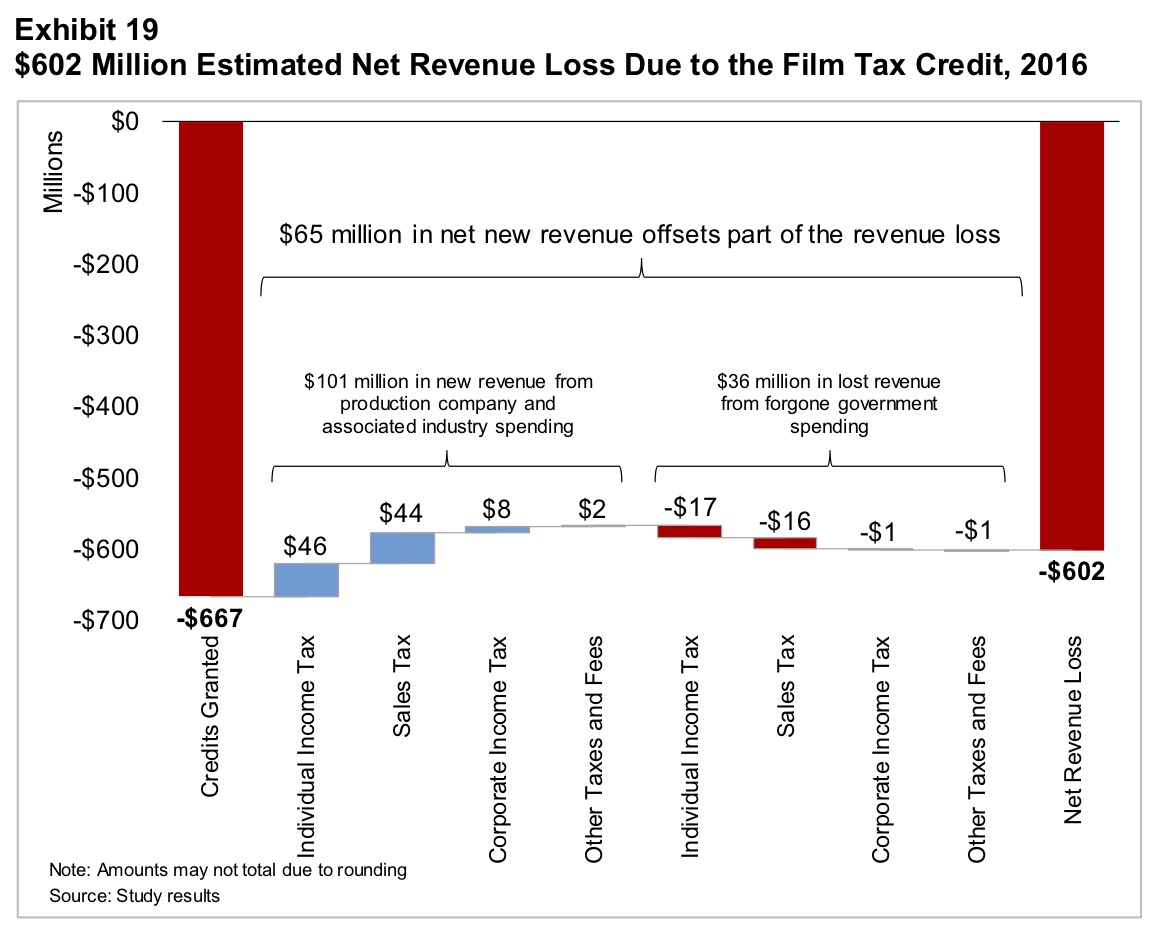

Audit Georgia S Return On Investment For Its Film Tax Credit Was 10 Cents On The Dollar

Georgia Film Tax Credits Paramount Tax And Accounting Llc

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Power Continues Renewable Energy Expansion By Seeking 1 000 Mw Of New Generation